In April 2015, KAYS announced that it has commenced with its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana. In October 2015, Oregon commenced legal recreational marijuana sales through licensed medical marijuana dispensaries, including those operated by the company.

Principles of Consolidation

The consolidated financial statements include the accounts of Kaya Holdings, Inc. and its subsidiary, Alternative Fuels Americas, Inc. (a Florida corporation) and Marijuana Holdings Americas, Inc. (a Florida corporation) which is a majority owned subsidiary. All inter-company accounts and transactions have been eliminated in consolidation.

Non-Controlling Interest

The company owns 55% of Marijuana Holdings Americas, Inc.

I wonder who owns the other 45%. Not much mention yet of any Alternative Fuels Americas business, a wholly owned sub.

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less. The Company had no cash equivalents

Cash was about $300,000 at 9/30/15. Sales have been minimal so far, under $100,000 for nine months up to 9/30/15, generating a net operating loss of over $1,000,000. These are still very young operations, although they show a high gross margin of about 60%. The economics of the business could be quite strong as they ramp up, if the gross margin is any indication. It appears the company conserves cash by paying for stuff with stock, these payments range from interest and principal payments on debt, equipment purchases, accrued expenses and payables, per the statement of cash flows. A key contributor to the struggle of many public cannabis related shares has been massive shareholder dilution.

It is in style these days among large established public companies to issue debt at low interest rates to repurchase stock. In theory, buybacks can be good, but success in creating value depends on price paid.

Below they discuss the accounting for the inventory of cannabis products and the equipment used to produce the products. Not a very strong inventory note. What about materials and supplies, weed in process?

Inventory

Inventory will consist of finished goods purchased, which are valued at the lower of cost or market value, with cost being determined on the first-in, first-out method. The Company will periodically review historical sales activity to determine potentially obsolete items and also evaluates the impact of any anticipated changes in future demand.

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation and is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Depreciation of property and equipment is provided utilizing the straight-line method over the estimated useful lives, ranging from 5-7 years of the respective assets. Expenditures for maintenance and repairs are charged to expense as incurred.

Upon sale or retirement of property and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the statements of operations.

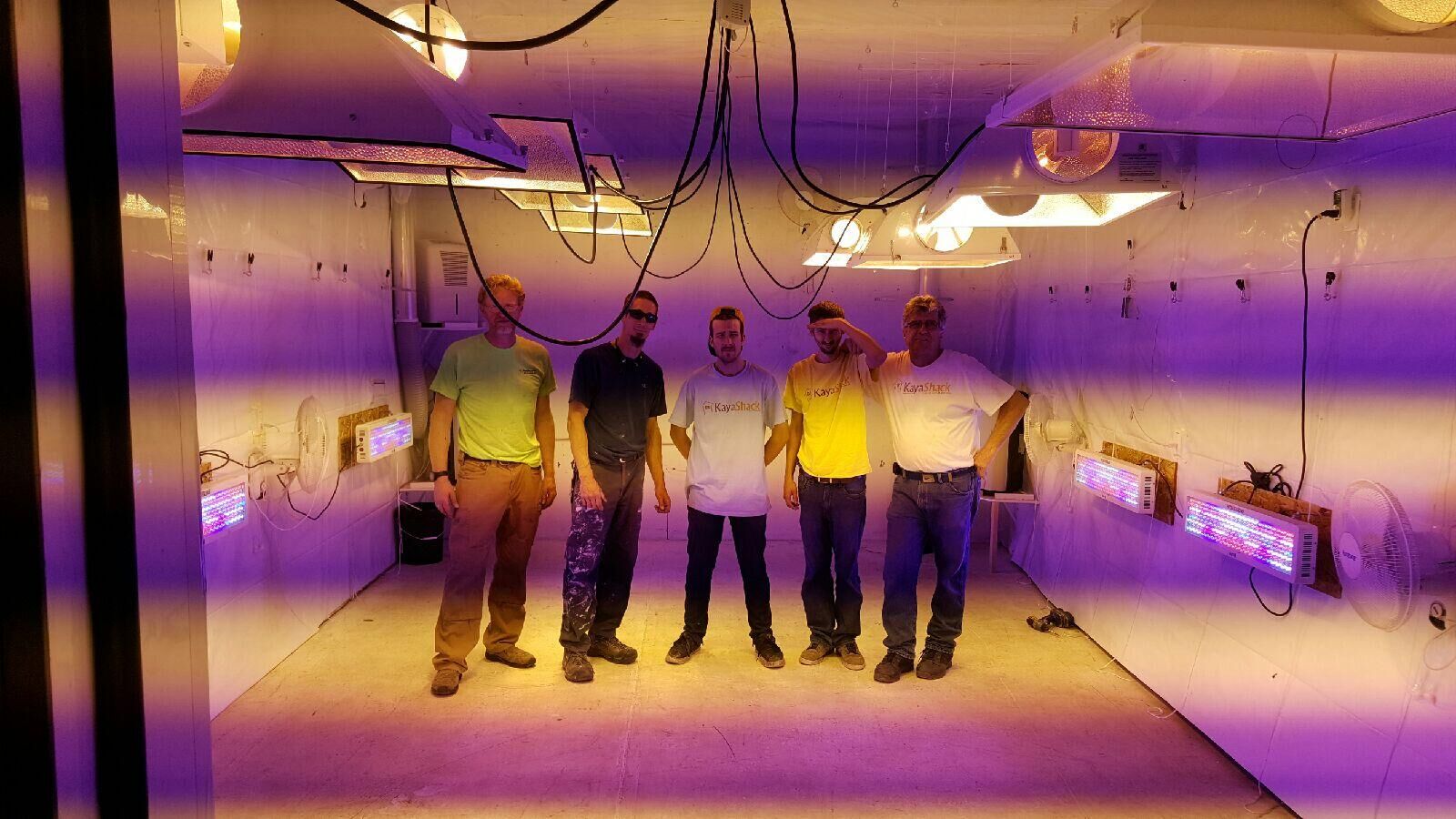

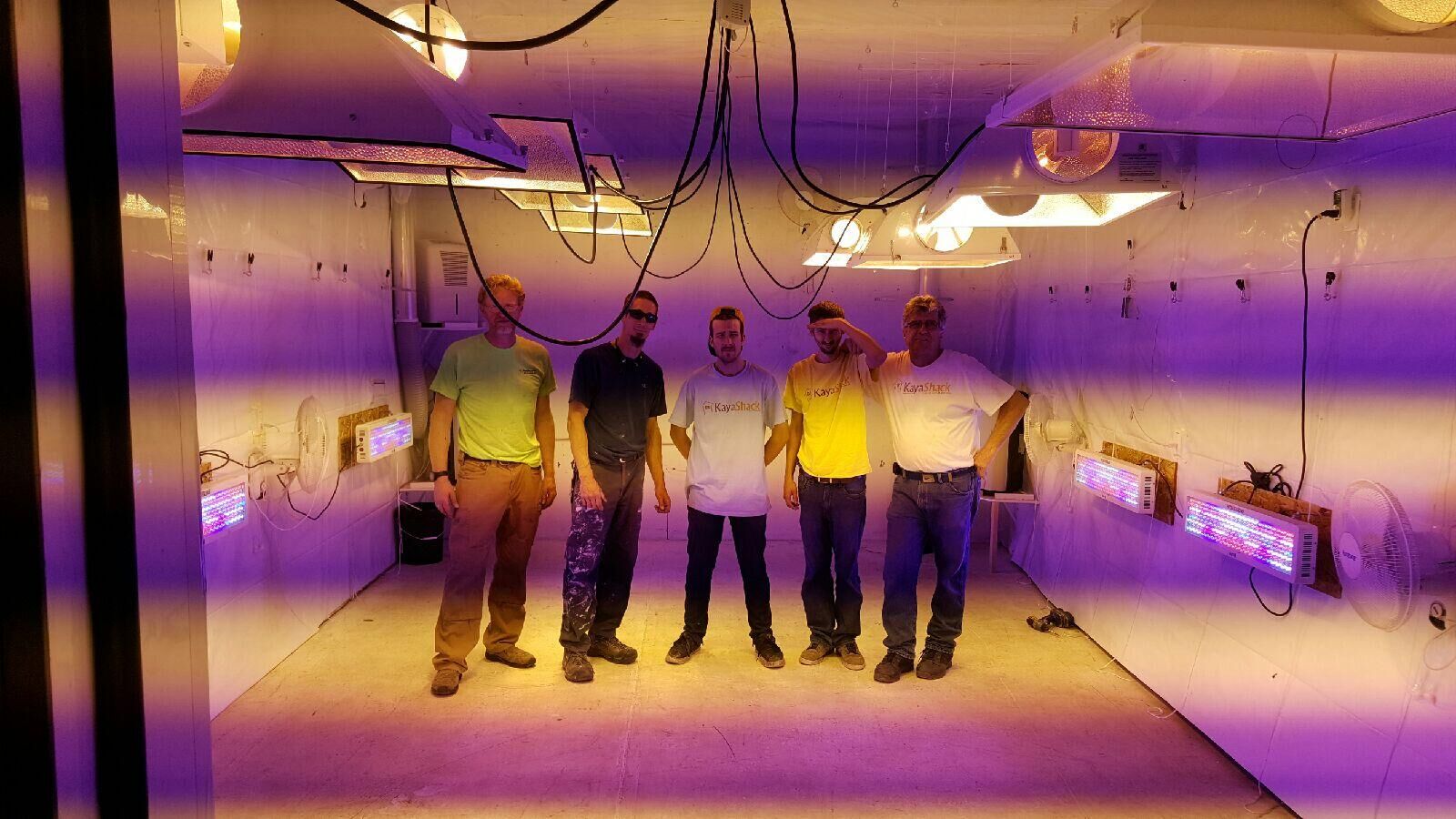

I found these Lease notes interesting, which talk about their leases on a cannabis store and a production facility. These spaces are shown in the pictures below.

In April, 2014 MJAI, through its wholly owned subsidiary, MJAI Oregon 1, LLC (MJAI Oregon 1) Oregon company, entered into a lease for space to operate their first medical marijuana dispensary in Portland, Oregon. The five-year lease requires MJAI Oregon 1 to pay a monthly rental fee of $2,255 the first year with annual lease payment escalations of 4% and a security deposit of $12,000. The dispensary is located are located at 1719 SE Hawthorne Boulevard, Portland, Oregon and will operate under the proprietary brand name of “Kaya Shack “TM.

On August 1, 2015 the Company announced that it had signed a lease for a 6,000 square foot facility in central Portland to serve as the Company's expanded Marijuana and Cannabis Manufacturing Complex and West Coast Operations Base.

The MD&A can be a good way to start to understand how management thinks about the business and it's growth. Below they discuss the alternative fuel business a little bit, too. Apparently, Kaya is the "first fully reporting U.S. public company to actually own and operate a vertically integrated seed-to-sale legal marijuana enterprise in the United States" and they aren't shy about it, wait until you see the pics.

Management Discussion and Analysis

Introduction

Kaya Holdings, Inc. (“KAYS”, “”we”, “us”, “our” or the “Company”) owns and operates brands that produce, distribute and sell premium cannabis products, including flower, concentrates, and cannabis-infused baked goods and candies. We are the first fully reporting U.S. public company to actually own and operate a vertically integrated seed-to-sale legal marijuana enterprise in the United States. Our operations include medical marijuana dispensaries ("MMDs"), that serve both medical marijuana patients and recreational customers medical marijuana grow operations ("Grows"), the manufacturing of proprietary cannabis products and the research and development of medical grade cannabis strains and extracts for pain relief and treatment of serious illnesses.

Background

From 2010 to 2014, the Company was engaged in seeking to develop a biofuels business. In January 2015, the Company determined that it was in the best interests of its stockholders to discontinue its biofuel development activities, and to instead leverage its agricultural and business development experience and focus all its resources on the development of legal medical and recreational marijuana opportunities in the United States, which the Company had commenced pursuing in 2014.

Following the successful introduction of legal recreational marijuana in Colorado in 2014, KAYS incorporated a subsidiary, Marijuana Holdings Americas, Inc. a Florida corporation (“MJAI”) to operate as a grower, processor, distributor and/or retailer of legal recreational and/or medical marijuana in jurisdictions where it is legal in accordance with State law. After an evaluation of several factors including barriers to entry, cost factors and potential rewards for success, the Company targeted Oregon as the first market to open a state licensed medical marijuana dispensary (MMD).

KAYS operated Development from March 2014 through the second quarter of 2015:

| • | | In March 2014, MJAI, through an Oregon subsidiary, applied for and was awarded its first license to operate a MMD. The Company developed the Kaya Shack™ brand for its retail operations and on July 3, 2014 opened the Kaya Shack at 1719 SE Hawthorne Boulevard in Portland, Oregon. Initial customer acceptance and media coverage was very positive, including many references to KAYS as the “Starbucks of Medical Marijuana” by television news stations, news print publications and online news sources. |

| • | | In March 2015 a Certificate of Amendment to the Certificate of Incorporation was filed changing the Company’s name from Alternative Fuels Americas, Inc, to Kaya Holdings, Inc. On April 6, 2015 FINRA approved the name and symbol change and on April 7, 2015 the company commenced trading under the new symbol “KAYS.” |

| • | | On April 9, 2015 KAYS announced that it had formed the Kaya Farms Medical Marijuana Grow to feed the Kaya Shack™ supply chain, becoming the first US publicly traded company to own a majority interest in a vertically integrated legal marijuana enterprise in the United States. As of April 30, 2015 KAYS employees and contractors had harvested the final round of our first medical marijuana crop trials which yielded the company nearly 25 pounds of Oregon Connoisseur-Grade Medical Marijuana since January 1, 2015. |

| • | | On June 3, 2015 KAYS confirmed that it has filed an application for an additional license to open its second Kaya Shack™ MMD in Oregon. The “Kaya Shack™ Marijuana Superstore” is designed to support potential revenue-enhancing opportunities under development by the Company as well as potential early recreational sales by existing MMDs in Oregon. |

| · | | On June 18, 2015 KAYS announced that it had reached an agreement on the principal terms to acquire assets from OC Harley Gardens, a Portland based marijuana grow, which produces high quality, connoisseur-grade, medical marijuana. The assets include an existing duly licensed patient base with associated plants and grower licenses, unique genetics, equipment, and use of the facility on a rent-free basis. |

| • | | On June 26, 2015 KAYS confirmed that it has been awarded a license by the Oregon Medical Marijuana Program to open its second Kaya Shack™. KAYS has met all of the criteria for the license, and final approval is subject to pre-opening inspection. The license for the new Kaya Shack Marijuana Superstore coincided with the Oregon Legislature Joint Marijuana Committee’s unanimous passing of an amendment to permit MMP dispensaries to sell marijuana to adults 21 and above beginning October 1, 2015. |

KAYS Operational Developments during the Third Quarter 2015 through October 31, 2015

| • | | On July 15, 2015 KAYS announced the completion of the OC Harley asset purchase agreement which added additional highly sought-after strains to the Kaya Farms portfolio (with THC levels ranging from 20-27%) and boosted KAYS production capabilities to meet increases in demand as we open additional shops and recreational sales come to Oregon. |

| • | | On July 29, 2015 KAYS announced that it had signed a lease on a 6,000 square foot facility in central Portland to serve as the Company's expanded Marijuana and Cannabis Manufacturing Complex and West Coast Operations Base. The Company has since consolidated all Kaya Farms Operations and assets into the new facility for a substantially expanded Grow with significantly increased volume capacities, and the site is currently undergoing development, planning and renovations to facilitate industrial-level marijuana product manufacturing. |

| • | | On August 18, 2015 KAYS announced that it had filed a license application for its third marijuana dispensary license, a planned Marijuana Superstore in North Salem, Oregon. The Company has completed a letter of intent to secure this 3rd retail location and has filed for the corresponding provisional license from the OMMP. This location, if successfully opened will provide KAYS with excellent coverage in Salem, a community with more than 400,000 people and comparatively few operating dispensaries. As with our South Salem store, this location is prime retail space, roughly three times the size of our first Kaya Shack and its location would give us the opportunity to introduce and expand concept innovations and additional potential revenue streams. |

| • | | On October 1, 2015 KAYS began adding legal recreational cannabis at its initial Kaya Shake™ location.

| • | | On October 20, 2015 KAYS announced that it had opened its 2nd retail

marijuana location, the Kaya Shack™ Marijuana Superstore in South

Salem, Oregon. Additionally, the company reported that recreational sales

launched October 1st at its flagship store in Portland, Oregon have resulted in a substantial increase in new customers, volume of transactions and

total sales revenues. For information regarding revenues and market

trends during the first 30 days of recreational sales, please see “Results of

Operations” below.

Market Overview- Legal Recreational and Medical Marijuana

The National Level

According to an article published by CBS News Moneywatch, the legal marijuana industry is the fastest growing business in the United States, with nearly 11 Billion Dollars in sales forecast for 2019. Steve Berg, a former managing director of Wells Fargo Bank has published a report citing Cannabis as being one of the fastest growing domestic industries, citing that “Domestically, we weren't able to find any market that is growing as quickly."

Estimates from various sources for the size of the long term market range from up to an excess of $100 billion if Federal Prohibition is repealed and marijuana sales become legal in all 50 states and Washington D.C. (for perspective beer is approximately a $100 billion market, with wine just under $30 billion and coffee approximately $12 billion).

Twenty-seven states and the District of Columbia have either legalized medical marijuana or decriminalized marijuana possession -- or both. Additionally, four states have voted-in recreational marijuana laws with active legal cannabis economies flourishing in Colorado and Washington. Effective October 1, 2015 Oregon has commenced with early recreational sales of marijuana (“flower” only, no concentrates or edibles) through existing medical marijuana dispensaries, with full recreational licensing and sales scheduled to begin in 2016.

Potential legislative actions and ballot initiatives are planned over the next two years for at least eight more states- Arizona, California, Hawaii, Maine, Massachusetts, Missouri, Nevada, and Wyoming.

Kaya Holdings operates the Kaya Shack™ brand of medical marijuana dispensaries.

Dubbed by the mainstream press as the “Starbucks of Marijuana” after our first store opened in July, 2014, our operating concept is simple- to deliver a consistent customer experience (quality products, fair prices and superior customer service) to a broad and diverse base of customers. Kaya Shack™ meets the quality needs of the “marijuana enthusiast”, the comfort and atmosphere preferences of “soccer moms” and the price sensitivities of casual smokers.

The Kaya Shack™ brand communicates positive thinking and joy, with signs adorning the walls that read “It’s a Good Day to have a Good Day” and “Some of our Happiest Days Haven’t Even Happened Yet” , and our signature “Be Kind” .

Kaya Shack™ Stores are open 7 days a week from 8:00 am to 9:00 pm. Operations follow an operational manual that details procedures for 18 areas of operation including safety, compliance, store opening, store closing, merchandising, handling of cash, inventory control, product intake, store appearance and employee conduct.

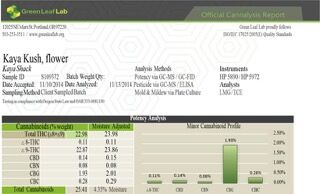

In compliance with regulations, all marijuana and marijuana infused products sold through our stores are quality tested by independent labs to assure adherence to strict quality and purity standards.

Our two currently operating locations operate as medical marijuana dispensaries (MMDs), and as of October 1, 2015 they became licensed to offer recreational sales pursuant to a bill passed by both Houses of the Oregon Legislature. When recreational licenses are available in 2016 we will apply for retail sales licenses for all locations but still intend to service our medical marijuana patients as the law permits.

CBS Oregon Affiliate KOIN Channel 6 Television News featured Kaya Holdings and the Kaya Shack Retail Marijuana Store in Portland, Oregon on the eve of recreational sales, and spotlighted the company’s stock and status as the first fully reporting US Public Company to commence legal recreational marijuana sales.

To see the video please click here. http://koin.com/2015/09/28/oregon-medical-pot-dispensaries-prep-for-rec-sales/

Retail Locations

I. Kaya Shack™ , 1719 SE Hawthorne Blvd., Portland, Oregon

Our flagship Hawthorne Boulevard Store opened July 3, 2014. The location is prime Portland real estate, located in an area that many term as “the Greenwich Village of Portland”.

The Portland facility currently features over 35 popular strains of marijuana including our proprietary, high-grade “Kaya Kush” (independent testing performed on 11/10/2014 confirms a total THC/Cannabinoid content in excess of 25%). Our stores also feature various concentrates, including butane hash oil (B.H.O.) and CO2 oil extract (wax, shatter) which range in potency from approximately 40% to over 80% THC, as well as high grade Oils and Tinctures, high CBD – low THC strains and “Kaya Candies”, “Kaya Caramels” and an assortment of cookies and cakes for patients who do not smoke.

|

Our second location (the first Kaya Shack™ Marijuana Superstore) opened for business on October 17, 2015 in South Salem, Oregon in time to take advantage of early recreational sales.

The store is located in first class strip mall space adjacent to “Little Caesars Pizza” and “Aaron Rents”, with a footprint roughly three times the size of our first Kaya Shack™ in Portland. The location and floorplan was carefully chosen with an eye towards concept expansion to enhance revenues and broaden branding opportunities.

In addition to the recreational and medical marijuana products as offered at our Hawthorne location, the space allows for additional products and concept innovations to be introduced. These include the Kaya Café Juice Bar™ (featuring THC and CBD enhanced juices and beverages) and the Kaya Clone Room™ (supplying marijuana plants and home cultivation accessories) and additional unique on-site concepts.

III. Kaya Shack™ Marijuana Superstore, North Salem, Oregon

Our third Kaya Shack™) is targeted to open late 2015 in North Salem, Oregon.

As of the date of this filing, the Company has completed a letter of intent with the landlord (the same landlord that leased us the South Salem Location) to secure this location and has filed for its provisional license from the Oregon Medical Marijuana Program (OMMP).

Upon securing the final lease (anticipated but not yet finalized) and the subsequent issuance of the provisional license from the OMMP upon positive acceptance of the application (also anticipated but not yet finalized), the Company intends to commence with site buildout and final licensing procedures similar to those described above.

As with the South Salem Store, the location is first class space, with a footprint roughly three times the size of our first Kaya Shack™ and we intend to offer additional products and concept innovations at this location. In addition to the benefits of our South Salem location, this location was chosen with an eye towards completing market penetration of the Salem Metropolitan Area which hosts a population base of approximately 400,000 people.

Note: In the event that the lease for this location is not finalized, KAYS has identified other perspective sites for its third Kaya Shake™ retail marijuana store.

Kaya Farms Consolidated Marijuana Grow and Manufacturing Facility, West Coast Base of Operations

|

Kaya Holdings operates the Kaya Farms Grow Operations and Manufacturing Facility to provide its Kaya Shack™ dispensaries with top grade connoisseur quality marijuana products including flower, concentrates and extracts, and edibles.

In August 2015 the Company leased a 6,000 square foot facility in central Portland to serve as the Company's expanded Marijuana and Cannabis Manufacturing Complex and West Coast Operations Base. To date the Company has consolidated the original Kaya Farms Grow operation and the newly acquired assets of OC Harley Gardens including equipment, plants and all related licenses into the new facility for a substantially expanded Grow with significantly increased volume capacities.

While the Company hopes to maintain long term operation at this site, capital improvements and equipment purchase are being done in a manner that would allow for evaluation relocation to another facility in the event that licensing laws currently under development mandated operational relocation. Our end goal is designed to increase the perpetual harvest room model to potentially include more than 100 strains of marijuana and substantially increase our production volume while lowering costs.

Kaya Shack/Kaya Farms Medical Marijuana Products

The Company’s proprietary strain of Kaya Kush Marijuana tested in excess of 25% total THC/Cannabinoid content in November 2014. Additionally, KAYS produced its first batch of its own concentrates in February 2015, which was tested by an independent lab at 94% total cannabinoid content.

The Company is currently gearing up production of flower for a signature line of strain-specific concentrates and pre-rolled cannabis cigarettes for sale through our retail network as well as potential distribution lines to other dispensaries. Additionally, the Company is evaluating different manufacturing opportunities and related activities at the space for a wide range of marijuana manufacturing opportunities.

As previously reported the Company’s expenses were substantially more compared to the same period the prior year, but these expenses were mostly stock issuances in the first quarter of 2015 (versus actual cash payments) to key management, consultants and professionals that were integral to the process of the company becoming the first fully reporting U.S. public company to actually own and operate a vertically integrated seed-to-sale legal marijuana enterprise in the United States

October 2015 The first thirty-one days of limited recreational marijuana sales

For the 15 month period that we have had our dispensary operations in Oregon (July 1, 2014 - September 30, 2015), Kaya Shack™ sales to medical marijuana patients totaled approximately $170,000 (a monthly average of approximately $10,600). For the 1 month period of (October 2015) sales to both medical and recreational patients totaled $64,480, an increase of over 500%.

To be clear, this one month period included sales from our new South Salem Kaya Shack Marijuana Superstore in addition to our Portland location, but the Salem store opened October 17 and only contributed approximately $12,300 to this figure (note: the Salem opening was a “soft opening” and the various enhanced revenue aspects of the store have yet to be launched).

Accordingly, even though we are dealing with a very short snapshot of the recreational market, the 500%+ increase in total sales for the company and nearly 400% increase in same store revenues at our established Hawthorne location is consistent with our thesis that the recreational marijuana market is much more lucrative for the company than medical sales. Additionally, if you factor in the fact that the “limited recreational sales” are exactly that (limited to flower only and no more than 7 grams to any individual per day) we are confident that revenues will increase once the limits are increased and our recreational customers can purchase larger amounts of flower as well as buy extracts, concentrates and edibles.

Management continues to believe that the larger opportunity will be with the new recreational market that will be unfolding in Oregon after January 2, 2016 that involves vertical integration utilizing Producer, Processor, Wholesaler and Retailer licenses. Unlike the medical marijuana program, there are no restrictions or limitations with the Recreational Market regarding patient qualifications, and a much larger market will open up for retail demand, which the Company intends to aggressively exploit by leveraging their Oregon MMD experience and public company status.

Other Markets

The Company intends to seek additional licensing opportunities in various states and territories throughout the country which have legalized recreational and/or medical marijuana use, as well as select states and territories where legalization is pending or is otherwise under consideration through joint efforts with the Drug Policy Alliance and the Drug Policy Alliance’s lobbying affiliate, Drug Action and other activists and lobbyists.

Potential future target markets include Alaska, Arizona, California, Colorado, Connecticut, Florida, Illinois, Michigan, Nevada, New Jersey, New York, Ohio, Pennsylvania, Texas, Vermont, Washington D.C., Washington State and others.

We cannot assure that we will be successful in raising additional capital to implement our business plan. Further, we cannot assure, assuming that we raise additional funds, that we will achieve profitability or positive cash flow. If we are not able to timely and successfully raise additional capital and/or achieve profitability and positive cash flow, our operating business, financial condition, cash flows and results of operations may be materially and adversely affected.

Liquidity and Capital Resources

During the third quarter of 2015 we issued $60,000 of debt with a stated interest rate of 10%. The debt is payable on December 31, 2015 and convertible into common shares at $0.03 per share.

During the third quarter of 2015 we issued $200,000 of debt with a stated interest rate of 10%. The debt is payable on September 21, 2017 and convertible into common shares at $0.03 per share.

During the third quarter of 2015 we issued $200,000 of debt with a stated interest rate of 10%. The debt is payable on September 9, 2017 the debt was issued with warrants with a exercise price of $0.0312 and an exercise period of five years beginning on September 9, 2017 or payment of the debt.

For the nine months ended September 30, 2015 we invested $56,369 in equipment at our grow location.

Accordingly, with increased capital improvements and increased expenses associated with the launch of our Medical Marijuana business plan the Company’s cash reserves as of September 30, 2015 were $302,782 versus $45,198 for the same period in 2014. While the Company believes that they will continue to have increased access to investment capital to develop its Medical Marijuana and Legal Recreational Marijuana business plan, there can be no assurance that this will be so.

Although the Company has achieved significantly more revenues in the nine month period ending September 30, 2015 and also saw a substantial increase in revenues since limited recreational sales commenced on October 1, 2015 and opened their second Kaya Shack MMD on October 17, 2015, the Company acknowledges that its Plan of Operations may not result in generating positive working capital in the near future. Although management believes that it will be able to successfully execute its business plan, which includes third-party financing and the raising of capital to meet the Company’s future liquidity needs, there can be no assurances in that regard. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this material uncertainty.

Here is the full 10-Q filing for the nerds.

Time to start looking at Tetratech, which I believe is a public company that owns plant production in California. Best weed filing yet!

Disclosure: I don't own shares in Kaya.